The Gene Editing Revolution — Technology, Companies, and Outlook (2025), Part I

CRISPR: A Breakthrough on Par with Antibiotics and DNA — Are We One Step Away from Cures for Cancer and HIV?

Informational and analytical only — not investment advice.

🐣🐣

Jiankui

Introduction

Few technologies have reshaped modern biomedicine as profoundly as gene editing. By rewriting DNA with unprecedented precision, scientists can now imagine cures that strike at the very root of genetic disorders, train immune cells to fight cancer, and even reduce the risks of widespread chronic diseases. At the heart of this revolution is CRISPR–Cas9. In 2020, it won the Nobel Prize in Chemistry, with the Committee declaring that it “may realize the dream of curing inherited diseases” [1]. Since then, billions of dollars have flowed into the field, fueling a wave of biotech startups and established players, all racing to turn that dream into clinical reality.

By the second half of 2025, the CRISPR revolution has entered a more mature phase: the first therapies have been approved and are reaching patients [2][3], while others are advancing through late-stage trials (SCD/TDT, ATTR, HAE, oncology). In this piece, we’ll map out the foundations, milestones, leading companies, and the realities of commercialization — with a focus on CRISPR Therapeutics, Intellia, and Editas.

What is Gene Editing and the CRISPR–Cas9 Technology?

Gene editing is the precise manipulation of DNA — adding, removing, or altering fragments of genes. Scientists have experimented with genetic engineering for decades, but earlier methods were costly and technically complex. The breakthrough came in 2012, when Jennifer Doudna and Emmanuelle Charpentier introduced CRISPR–Cas9.

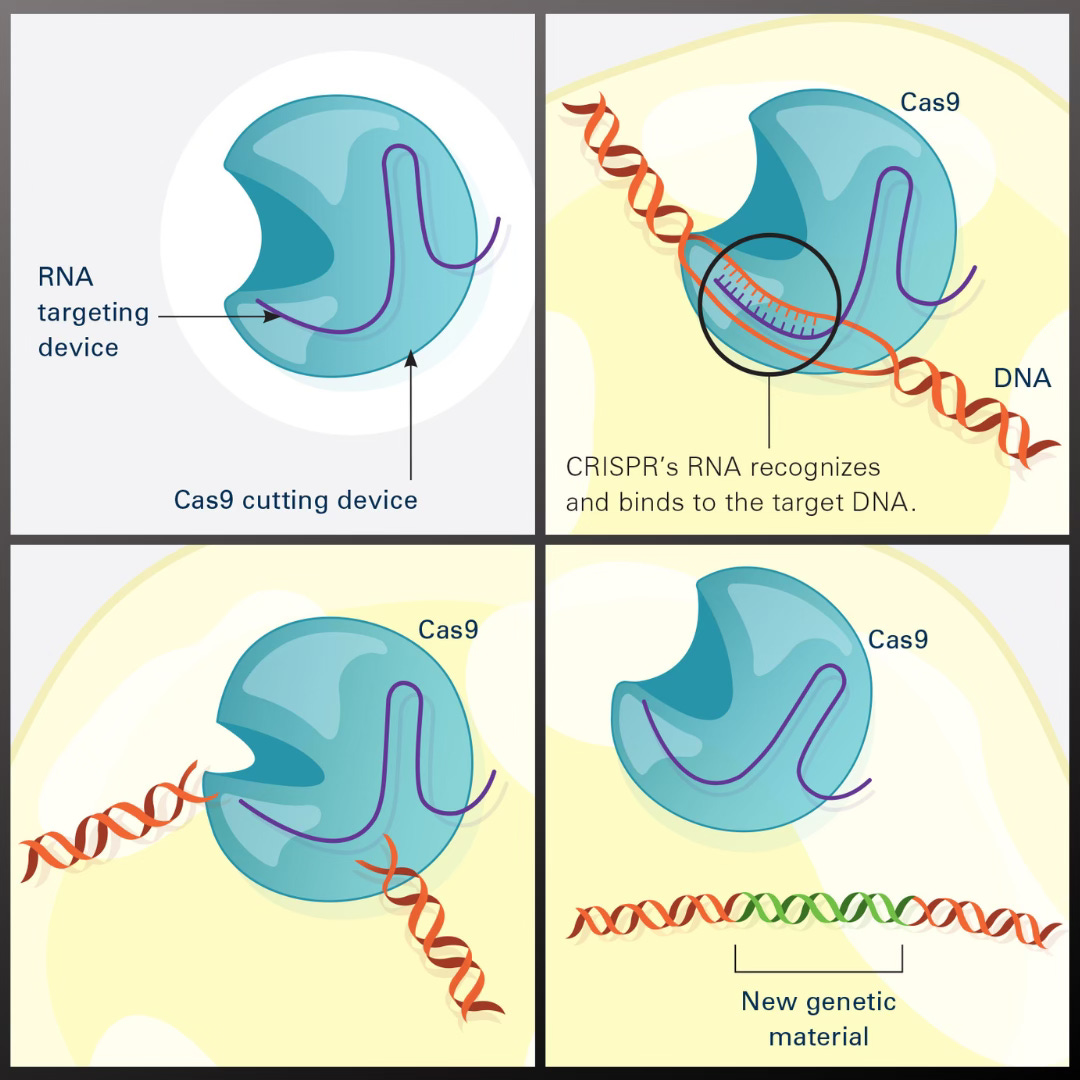

The CRISPR–Cas9 mechanism is borrowed from a natural defense system bacteria use against viruses. Researchers managed to reprogram it so that it cuts DNA at a precisely chosen spot. Think of it as molecular scissors with a built-in GPS: the Cas9 enzyme slices the DNA at the exact location indicated by a short guide RNA (designed to match the target sequence) [4][5]. Once the cut is made, the cell’s natural repair machinery kicks in, rejoining the broken strands. That’s the critical moment when scientists can introduce changes — disabling a faulty gene or inserting a correct version of DNA.

Why Did CRISPR Spark Such Strong Reactions? 🤯🔬

Compared to earlier gene-editing tools like zinc-finger nucleases (ZFNs) or TALENs, the CRISPR–Cas9 system proved to be simpler, cheaper, and far more versatile. Designing the guide RNA for a chosen gene can be done entirely on a computer, which meant labs around the world could quickly adopt and apply the technology.

CRISPR makes it possible to edit virtually any gene in almost any organism — from human cells, to lab animals, to crop plants. The medical applications are especially promising: repairing mutations responsible for genetic disorders (such as sickle cell anemia or cystic fibrosis), disabling genes that allow viruses like HIV to persist in the body, or reprogramming immune cells to attack cancer. 🌱🧪

From CRISPR to CRISPR 2.0 🚀🧬

The prospect of curing once-incurable diseases at their genetic roots has earned CRISPR the label of a revolutionary technology. It’s often compared to the discovery of DNA’s structure or the invention of antibiotics.

Still, CRISPR–Cas9 is not the only gene-editing tool — it’s more like the first generation of a fast-evolving toolkit. What scientists now call CRISPR 2.0 includes base editing and prime editing, both designed to make the process more precise and safer.

Base editors, developed by David Liu at Harvard, allow single-letter changes in DNA without cutting the double helix. That makes it possible to correct point mutations with greater safety [8]. Prime editing, first described in 2019, combines CRISPR with reverse transcriptase, enabling the insertion or replacement of entire DNA fragments with remarkable precision [9]. It’s considered the most versatile tool yet — theoretically capable of introducing almost any change in the genome.

In 2025, prime editing crossed a historic milestone: it was applied experimentally in humans for the first time [10]. That May, Prime Medicine reported the first clinical results in a patient with chronic granulomatous disease (CGD). Nature described the achievement as the first-ever use of prime editing in humans [117].

The History and Milestones of CRISPR ⏳🧬

Although the CRISPR boom took off in the 2010s, the idea of editing genes has a much longer history. Back in the 1990s, researchers were already developing zinc-finger nucleases (ZFNs) — the first artificially designed “molecular scissors.” Around 2011, TALEN nucleases appeared, based on bacterial DNA-binding proteins. Both methods worked, but they were complex and expensive to design, which slowed their translation into medicine.

The true breakthrough came in 2012, when Emmanuelle Charpentier and Jennifer Doudna published their landmark paper showing that the bacterial CRISPR–Cas9 system could be repurposed as a tool to cut DNA at virtually any chosen site [1]. Independently, Feng Zhang’s team at the Broad Institute published similar results a few months later. This sparked not only a scientific race but also a fierce patent battle between the University of California and the Broad Institute over rights to a technology worth hundreds of millions of dollars. In the end, both sides secured parts of the patent portfolio, and biotech companies today license CRISPR from one or the other. The dispute itself underscored just how valuable — and hotly contested — the discovery had become.

Riding the wave of enthusiasm, the years 2013–2015 saw the birth of the first CRISPR-focused startups. In 2013, Editas Medicine was founded, co-initiated by Feng Zhang and genomics pioneer George Church. The following year, Intellia Therapeutics was launched with Jennifer Doudna as a co-founder, while in Switzerland, Emmanuelle Charpentier co-founded CRISPR Therapeutics. These three companies formed the first wave of CRISPR biotech and later debuted on NASDAQ, raising hundreds of millions of dollars from investors. Media attention exploded — CRISPR appeared in The New York Times, in popular magazines, and on science shows. The period was sometimes described as “CRISPR-mania,” with soaring expectations of miracle cures for cancer, HIV, genetic disorders, and beyond. 🌍

The first human clinical trials with CRISPR began in the mid-2010s. In 2016, a Chinese oncology team used CRISPR-edited immune cells in a patient with lung cancer — a pioneering but experimental attempt that was never widely reported [13].

The next leap came in 2019 in the United States, where researchers launched a clinical trial for sickle cell disease. Stem cells from patient Victoria Gray’s bone marrow were edited to produce healthy hemoglobin. Soon after, a similar approach was tested for beta-thalassemia, another severe blood disorder. That same year, Editas began a first-of-its-kind trial for Leber congenital amaurosis, a rare inherited blindness, injecting a CRISPR-based vector directly into the eye. This marked the first in vivo use of a gene editor in the United States. 👁️✨

In 2020, Intellia Therapeutics pushed the frontier further with the first systemic gene editing directly inside the body. In the NTLA-2001 trial, patients received nanoparticles carrying mRNA encoding CRISPR, which traveled to the liver and disabled the gene responsible for transthyretin amyloidosis — a fatal protein-folding disease. In 2021, it was announced that this one-time therapy reduced toxic protein levels by more than 80% [14]. The result was hailed as a breakthrough: the first proven success of systemic in vivo gene editing in humans.

Regulatory approvals soon followed. In November 2023, the UK’s MHRA became the first agency worldwide to approve Casgevy for sickle cell disease (SCD) and beta-thalassemia (TDT). The U.S. FDA followed, approving Casgevy for SCD on December 8, 2023, and for TDT on January 16, 2024. In the EU, the therapy received conditional approval on February 13, 2024 (for patients aged 12+). In the U.S., the list price for Casgevy was set at roughly $2.2 million, while Bluebird Bio’s alternative gene therapy Lyfgenia came in at around $3.1 million [2][3][116]. 💰💉

It took just eleven years to move from the first CRISPR publications to life-saving therapies. “Going from the lab to an approved treatment in only 11 years is truly an extraordinary achievement,” said Jennifer Doudna, reacting to the approval of Casgevy [16].

She also emphasized the symbolism: the first CRISPR therapy targets sickle cell disease — a condition long neglected by medicine, now offering hope of a cure to thousands of patients [17].

— One could say the era of gene-editing medicine has officially begun. Having proven that CRISPR can safely and effectively treat severe genetic disorders, the door is now wide open for its next applications.

Lulu and Nana — The Birth 🎉🤯

The road from an idea born in the lab to a therapy used in patients is never straightforward. For CRISPR, the path was marked not only by technical hurdles but also by profound ethical questions — where should science draw the line?

In 2018, the world learned the name He Jiankui. The Chinese researcher announced that he had edited the genes of human embryos — and that two girls, Lulu and Nana, had been born. In a short video posted online, he spoke of them almost as symbols of a new era, emphasizing that they were “as healthy as any other children.”

The first video in which He Jiankui announced the birth of Lulu and NanaThe goal of the experiment sounded simple enough: disable the CCR5 gene so that the girls would be resistant to HIV infection [11]. The problem was that CCR5 is not just a gateway for HIV — it’s also part of the immune system. Its absence can make people more vulnerable to other infections, like West Nile virus or even influenza. Scientists knew this all too well. That’s why, instead of admiration, He Jiankui’s announcement triggered a wave of condemnation.

A few days later, at a conference in Hong Kong, Jiankui faced a packed auditorium of researchers. What unfolded was not a scientific debate but a reckoning over responsibility and ethics. One attendee later remarked that the atmosphere felt like a trial — only this time, it was the scientific community delivering the verdict. ⚖️

His story became a warning. It underscored that a technology capable of rewriting the code of life demands not just knowledge and boldness, but boundaries. 🚧

Since then, editing the human germline has been placed under a global moratorium. Research has been redirected exclusively to somatic cells, which can be altered without affecting inheritance.

And yet, despite the scandal, the field didn’t stall. The following years brought dozens of clinical programs aimed at patients suffering from severe, otherwise incurable genetic diseases. This time, however, researchers advanced step by step — with safety and ethics at the forefront, as if the memory of Lulu and Nana still hovered over every experiment.

The Gene Editing Landscape and Its Key Players 🗺️

The rapid rise of CRISPR has given birth to an entire biotech sector focused on genome editing. Below, we’ll look at the most important publicly traded companies in the field — their profiles, achievements, and the challenges they face.

Each has chosen its own strategy and therapeutic niche, but they all share the same central idea: using precise DNA editing as a way to treat disease. We’ll take a closer look at CRISPR Therapeutics, given its pioneering role, but also explore other major players shaping the field: Intellia, Editas, Beam, Caribou, along with newer entrants like Prime Medicine and Verve Therapeutics.

CRISPR Therapeutics — The Pioneer with the First Approved Therapy 📃🏆

Founded in 2013 by Emmanuelle Charpentier, CRISPR Therapeutics became the first company to bring a gene-editing therapy to market. Together with Vertex Pharmaceuticals, it developed exa-cel (marketed as Casgevy) for patients with sickle cell disease (SCD) and beta-thalassemia (TDT).

The approach is powerful but complex: stem cells are taken from the patient’s bone marrow, the BCL11A gene (which suppresses fetal hemoglobin production) is switched off using CRISPR, and the edited cells are transplanted back after conditioning therapy. The result? The body starts making healthy fetal hemoglobin instead of the faulty adult version [3][18].

The phase 3 results were groundbreaking:

93.5% of sickle cell patients were free from vaso-occlusive crises for a full year.

25 out of 27 beta-thalassemia patients became independent of blood transfusions [19][20].

This success led to regulatory approvals in 2023 [15], a milestone confirming that CRISPR could form the basis of safe and effective therapies [21]. 🚀

Expanding the Pipeline

Beyond exa-cel, CRISPR Therapeutics is building a broad portfolio, cementing its role as a leader in gene editing:

1. Oncology (CAR–T therapies)

Traditional CAR–T therapies use a patient’s own T cells (autologous). CRISPR Therapeutics is pioneering allogeneic CAR–T, using donor-derived T cells that are edited to remove rejection markers and enhanced to attack cancers more effectively [22][23].

New generations like CTX112 (CD19) and CTX131 (CD70) include expanded edits (e.g. TGFBR2 and Regnase-1) to reduce T cell exhaustion and boost activity.

Phase 1/2 trials are ongoing in lymphomas, leukemias (CD19), and solid tumors like kidney cancer (CD70) [30][31].

Challenges remain (rejection, relapse [32][33]), but CRISPR’s iterative upgrades and streamlined manufacturing give it an edge.

2. Type 1 Diabetes

In partnership (later acquisition) with ViaCyte, the company is developing stem-cell–derived pancreatic cells edited with CRISPR to be “invisible” to the immune system, avoiding the need for lifelong immunosuppression [34][35]. Early trials are underway, with the ambitious goal of restoring natural insulin production — a potential functional cure for diabetes.

Strengths and Challenges

CRISPR Therapeutics’ biggest advantage is clear: it was the first to market a CRISPR therapy (exa-cel/Casgevy), giving it unmatched scientific and clinical credibility. The target market is significant — in the U.S. alone, ~100,000 people live with sickle cell disease, and globally beta-thalassemia affects tens of thousands more. Its partnership with Vertex provides financial backing, clinical expertise, and regulatory experience — critical for commercialization.

The company also benefits from a broad pipeline (rare diseases, oncology, diabetes) and access to key CRISPR patents(via Doudna/Charpentier licensing), securing its position as a cornerstone player in the field.

But challenges remain:

Complex procedure: exa-cel requires a bone marrow transplant with intensive chemotherapy upfront [36][37].

High cost: ~$2.2 million per patient [38].

Accessibility: only specialized centers can deliver it, limiting near-term revenues.

Payer negotiations: CRISPR and Vertex must persuade insurers and health systems that a one-time cure is more cost-effective than decades of chronic care [39].

Competition: Bluebird Bio already won FDA approval for Zynteglo (beta-thalassemia, 2022) and Lyfgenia (sickle cell, December 2023), creating direct head-to-head battles [2][3].

This means CRISPR Therapeutics isn’t just competing with itself — it faces off against another cutting-edge platform: viral vector–based gene therapies. And the challenges aren’t only scientific. The financial picture remains tough. Despite its partnership with Vertex, the company — like most early-stage biotechs — has been running at a loss.

Across the biotech sector, investor pressure is mounting: cut costs, deliver profits faster. In 2023, CRISPR Tx reduced headcount by ~50 employees (~10%), and in 2025 announced another round of layoffs (numbers undisclosed). Management framed it as a focus on “key priorities” and greater operational discipline [40][41]. In reality, it’s part of a broader industry trend — capital markets are demanding higher efficiency and a leaner, more selective approach to pipelines.

In other words, the scientific revolution of CRISPR hasn’t yet translated into a financial breakthrough. Despite medical success, the company’s stock hasn’t soared as some once predicted. Shares of CRSP remain volatile, though as of mid-2025 the company still holds the leadership crown, with a market cap of around $6 billion — comfortably ahead of its competitors [42][43]. 🐎

Intellia Therapeutics — Editing Genes Inside the Body 🧬💉

Founded in 2014 with the involvement of Jennifer Doudna, Intellia Therapeutics set itself apart early on with a bold strategy. While most companies pursued ex vivo therapies (editing a patient’s cells outside the body, then transplanting them back), Intellia focused on the riskier but potentially transformative path of in vivo editing — rewriting genes directly inside the patient.

This approach eliminates the need for complex transplant procedures and opens the door to one-time therapies with broad potential [44].

The Platform: CRISPR Delivered by LNPs

Intellia built its platform around lipid nanoparticles (LNPs) — the same delivery vehicles that powered mRNA vaccines. These LNPs transport CRISPR’s toolkit (Cas9 mRNA + guide RNA) into the liver, which naturally acts as a “filter” for LNPs, making it the ideal first target [45].

NTLA-2001: ATTR Amyloidosis

The flagship program, NTLA-2001, is aimed at hereditary transthyretin amyloidosis (ATTR) — a disease caused by toxic buildup of misfolded TTR protein in nerves and the heart. Instead of fixing the mutation, the therapy shuts down the TTR gene entirely in liver cells, halting production of the harmful protein [46][47]

The results have been striking:

A single IV infusion reduced TTR levels by >80% at low doses and >90% at higher doses [14][48].

The effect has lasted for at least two years of follow-up, confirming durable genome editing [49].

For context: existing drugs only stabilize TTR or modestly reduce it — nowhere near this magnitude of reduction.

On safety, the therapy has shown a favorable profile: mostly mild infusion-related reactions, with serious events rare and manageable. That balance of risk and benefit helped Intellia secure FDA clearance to begin phase 3 trials in 2023 [50][51], with a large randomized study now underway [52]. If successful, NTLA-2001 could become the second CRISPR therapy ever approved, likely around 2026–2027.

NTLA-2002: Hereditary Angioedema (HAE)

Intellia’s second major program, NTLA-2002, targets hereditary angioedema (HAE) — a rare disease marked by recurrent, life-threatening swelling attacks. The strategy mirrors NTLA-2001: permanently disable the KLKB1 gene, which drives excessive inflammation.

Phase 1/2 results have been eye-opening:

After a single CRISPR infusion, most patients experienced no further swelling attacks for months.

Some were able to discontinue existing preventive medications without relapse [53][54].

At the highest dose, the disease-causing protein dropped by ~90% within four months [55].

Crucially, no serious adverse events have been reported, and the therapy has been well tolerated. The FDA granted Orphan Drug and RMAT status, while EMA gave it PRIME designation [58]. — regulatory signals that highlight its promise. A global phase 3 trial is expected to launch in 2025 [56][57].

Other Programs & Partnerships

Beyond ATTR and HAE, Intellia and its partner Regeneron are testing CRISPR in hemophilia (to boost clotting factor production via liver editing), as well as in other metabolic and rare diseases. Oncology is on the radar, but Intellia has invested less aggressively in CAR–T than competitors, focusing instead on its in vivo strength.

Notably, Intellia has been a leader in developing systematic ways to monitor off-target effects. So far, no major issues have been seen in trials, suggesting CRISPR’s risks can be managed at acceptable levels.

Strengths

Pioneer in in vivo editing — potentially the future of genetic medicine.

Durable, one-time therapies — ATTR and HAE data show diseases can be silenced with a single infusion.

Regulatory momentum — first-ever FDA greenlight for an in vivo CRISPR phase 3 trial [52],

Delivery expertise — deep know-how with LNPs, a proven modality.

Big partnerships — Regeneron and UC Berkeley licensing provide both resources and patent strength.

🍒 ATTR (NTLA-2001): first successful systemic in vivo CRISPR editing in humans; durable >80–90% TTR reductions; phase 3 ongoing.

🍒 HAE (NTLA-2002): single infusion largely eliminated swelling attacks; moving toward global phase 3 in 2025 with strong regulatory backing.

Weaknesses

Long-term unknowns — permanently disabling genes raises questions about safety decades later (e.g. theoretical cancer risks from off-target edits). Patients will need lifelong monitoring.

Commercial uncertainty — ATTR and HAE are rare diseases; success is promising but markets are smaller than broad-population conditions.

Fierce competition — rivals like Beam (base editing) and Prime Medicine (prime editing) offer next-gen precision. Verve and others are also testing ATTR approaches.

Investor fatigue — despite breakthrough clinical data, Intellia’s stock dropped sharply in 2022–23, as investors realized revenues are still years away.

By mid-2025, Intellia’s market cap was about $1.2 billion — far below CRISPR Therapeutics, despite its breakthrough clinical results [42][43]. The message is clear: the market still values its future revenues cautiously. Global phase 3 trials, plus the manufacturing and commercialization that follow, will likely require substantial capital. That could mean more partnerships or additional equity raises — adding pressure on investors. 💸

From a scientific perspective, the company also faces a major challenge: delivering CRISPR beyond the liver. Lipid nanoparticles (LNPs) work beautifully in the liver, which naturally traps them through the reticuloendothelial system. But to edit genes in the lungs, brain, or muscles, new solutions will be needed — alternative vectors or redesigned LNP chemistry. Intellia is actively investing in this area, though it remains early-stage research.

Despite these hurdles, Intellia remains firmly among the top tier of gene-editing companies. Its programs continue to generate excitement across both the scientific community and patient advocacy groups. 🌍✨

Editas Medicine — From Eyes to Blood: The Race to Catch Up 👁️🚡🩸

Founded in 2013 with an A-list roster — Feng Zhang, George Church, and initially Jennifer Doudna (who later moved to Intellia) — Editas Medicine was one of the first CRISPR companies. With early access to Broad Institute patents (via Zhang), the company initially held a legal edge in using Cas9 for human genome editing.

The First Bet: Eye Diseases (EDIT-101)

Editas’ first target was Leber congenital amaurosis type 10 (LCA10), a genetic eye disease caused by mutations in the CEP290 gene. Its candidate, EDIT-101, was designed to directly edit the gene in retinal cells, delivered by a CRISPR vector injected under the retina.

In 2019, Editas carried out the first-ever in vivo CRISPR treatment in the U.S., dosing human patients. Over the following years, a small group received varying doses. By 2021–2022, results showed only modest improvements: some patients reported better light sensitivity or peripheral vision, but effects were inconsistent and hard to conclusively attribute to the therapy [59].

Safety was acceptable — no major issues reported — but the lack of clear efficacy led Editas to seek a partner for further development [60], while it shifted resources toward blood diseases.

A Pivot to Blood Disorders (EDIT-301)

Parallel to its eye program, Editas was developing a hematology strategy using a different enzyme: Cas12a (Cpf1). Unlike Cas9, Cas12a cuts DNA differently, leaving “sticky ends” and targeting different sequences.

Their therapy, EDIT-301, edits the BCL11A gene in blood stem cells, boosting fetal hemoglobin (HbF) to counter sickle cell disease (SCD) and beta-thalassemia. Results from phase 1/2 studies (RUBY and EDITHAL) have been very strong:

In 11 SCD patients, all achieved high HbF levels and none experienced vaso-occlusive crises post-treatment [61].

In 6 beta-thalassemia patients, all became transfusion-independent [62].

Follow-up lasted at least 5 months (longer for some), with no serious adverse events linked to the therapy.

The FDA granted Orphan Drug and RMAT status [63]. If results hold in larger groups, EDIT-301 could make Editas a credible competitor to CRISPR Therapeutics in blood diseases.

Strategic Shifts

EDIT-301’s success is critical for the company’s survival. Editas has undergone significant restructuring: a CEO change, staff cuts, and program prioritization. Costly, uncertain projects like EDIT-101 were deprioritized, while resources were refocused on hematology.

The company is also exploring oncology:

With Bristol Myers Squibb, Editas is testing T-cell editing.

Independently, it’s studying natural killer (NK) cell editing.

Both are early-stage efforts.

Strengths

Cas12a advantage: first to bring this nuclease into the clinic. Cas12a’s distinct cutting style could be superior in certain indications [61].

Flexibility: ability to deploy both Cas9 and Cas12a expands its scientific toolkit.

Strong patent portfolio: especially tied to the Broad Institute, giving Editas legal freedom to operate.

Survival and focus: after restructuring, the company has streamlined toward its most promising asset, EDIT-301.

Market opportunity: with a market cap of only ~$400–500M in 2025, Editas could be an attractive acquisition target — or deliver outsized returns if EDIT-301 succeeds.

Weaknesses

Lost ground: years of falling behind rivals and underwhelming EDIT-101 results damaged credibility.

Single-point dependency: current leadership has bet everything on EDIT-301 — a high-risk, high-reward strategy.

Weak partnerships: unlike CRISPR Therapeutics (Vertex) or Intellia (Regeneron), Editas lacks a strong late-stage partner.

Financial strain: phase 3 trials will require significant funding, likely needing new partners or equity raises.

Brand perception: Editas doesn’t carry the same investor trust or “hype factor” as CRISPR Tx or Intellia.

Outlook

If EDIT-301 continues to deliver strong results, Editas could stage a comeback and reassert itself among CRISPR’s frontrunners. But with limited resources, no major commercial partner, and intense competition, the company is operating on thin ice.

For now, Editas remains a company with big scientific promise (Cas12a, EDIT-301) but a fragile financial and strategic position. Whether it reclaims a leading role — or becomes an acquisition target — depends almost entirely on the success of EDIT-301.

Conclusion to Part I 👨🏻🍳

Editas, Intellia, and CRISPR Therapeutics ushered in the era of gene-editing commercialization. They proved that CRISPR–Cas9 is not only a scientific breakthrough but also a foundation for entirely new business models. Their rapid growth and public market debuts drew the eyes of the entire biotech industry — along with hundreds of millions of dollars in funding.

But this is only the beginning of the story. In Part II, we’ll turn to the next wave of players joining the race. We’ll also dive into the latest clinical results from 2023–2025 and explore the challenges that could determine whether gene editing becomes a lasting pillar of modern medicine.

🧬

This material is provided for educational and informational purposes only. It does not constitute investment advice or an offer within the meaning of applicable law. The author bears no responsibility for investment decisions made on the basis of this content.

📚 Selected References

· U.S. Food and Drug Administration – press release on the approval of the first CRISPR therapy (Casgevy) for sickle cell disease [2][3].

· Innovative Genomics Institute, CRISPR Clinical Trials: A 2024 Update – overview of ongoing CRISPR trials, including results in SCD/TDT, ATTR, HAE, and CAR-T [111][48][53][70].

· STAT News, Jason Mast, The CRISPR companies are not OK (2025) – analysis of the sector’s challenges and the gap between scientific breakthroughs and financial success [1][40].

· Nanalyze, When Will Gene Editing Stocks Finally Take Off? (2025) – examination of correlations and valuations across gene-editing companies [109][43].

· Nature News, Heidi Ledford, World first: ultra-powerful CRISPR treatment trialled in a person (2025) – coverage of the first use of prime editing in a human patient [9][10].

· The Guardian, Ian Sample, Chinese scientist who edited babies’ genes jailed for three years (2019) – report on He Jiankui’s case and its ethical fallout [11][12].

· Fierce Biotech, James Waldron, Graphite’s hopes for sickle cell ‘cure’ blunted after first patient dosed experiences serious event (2023) – report on Graphite Bio’s halted trial [103].

· U.S. FDA – background on indications and mechanism of action for Casgevy and the parallel lentiviral therapy (Lyfgenia) [2][3].

(Sources: high-reputation English-language publications with up-to-date scientific and financial data as of August 2025.)

📖 References

[1] [40] [59] The CRISPR gene editing revolution loses its mojo. STAT News. (Feb 2025). Link

[2] [3] [4] [5] [18] [116] FDA Approves First Gene Therapies to Treat Patients with Sickle Cell Disease. FDA Press Release. (Dec 2023). Link

[6] [7] CRISPR Illustration. National Institute of General Medical Sciences. Link

[8] [13]–[15], [19]–[21], [22]–[39], [41], [44]–[49], [50]–[58], [61]–[63], [64]–[111] CRISPR Clinical Trials: A 2024 Update. Innovative Genomics Institute. (2024). Link

[9] [10] Ledford H. World first: ultra-powerful CRISPR treatment trialled in a person. Nature. (2025). Link

[11] [12] Sample I. Chinese scientist who edited babies’ genes jailed for three years. The Guardian. (Dec 2019). Link

[42] [43] [79] [109] When Will Gene Editing Stocks Finally Take Off? Nanalyze. (Jul 2025). Link

[60] Editas, changing course again, looks to partner lead CRISPR therapy. BioPharma Dive. (2024). Link

[103]–[106] Waldron J. Graphite’s hopes for sickle cell ‘cure’ blunted after first patient dosed experiences serious event.Fierce Biotech. (2023). Link

[110] Allogene Therapeutics Presents Updated ALLO-501/501A Phase 1 Data. ASCO Annual Meeting. (2024). Link

[111] Exploring FDG PET + MRI for multiple myeloma staging. J Clin Oncol. ASCO (2024). Link

[112] [113] [115] Caribou Biosciences Reports Q2 2025 Results and Pipeline Update. Caribou Investor Relations. (Aug 2025). Link

[114] CB-010 (ANTLER trial) clinical update. J Clin Oncol. ASCO (2024). Link

[117] Prime Medicine announces breakthrough clinical data (PM359, CGD). Prime Medicine Investor Relations. (2025). Link